can payday loans go on your credit

7 Choices to Funds Your Hillcrest Home Redesign

Come across seven resource alternatives for the Hillcrest family remodeling venture. From dollars in order to framework money, find a very good complement your financial budget and requirements.

Murray Lampert might have been design, renovations, and you may building house into the North park because the 1975. At that time, we have seen of a lot changes in do-it-yourself funding. Luckily, now you will find high loan applications for customers seeking to generate the new residential property or improve their most recent features.

Before you could score too far afterwards on the thrill off making your house remodel, custom kitchen area, or in-legislation collection, it is critical to have a sensible concept of exactly what a normal family renovation enterprise can cost you.

We advice setting-up a spending plan, along with outlining just how might shell out for your house renovations enterprise. Which have favorable rates and excellent mortgage software, even although you enjoys money on hands, you may be better off holding on to help you they.

Below we detail by detail probably the most well-known alternatives one to property owners believe ahead of they begin a property recovery. It is your decision becoming aware of the novel monetary state and would what is right for you plus friends. Having people large financial support, you should know every consequences and choose the brand new recommendations that meets your most useful.

Option 1: who does lot loans in Opp Alabama Cash

Expenses money is always the most suitable choice in terms to capital a house update investment (versus taking right out a personal line of credit). not, it is not reasonable to assume most property owners have the money to have a major remodeling opportunity readily available. In some instances, the average framework otherwise remodeling endeavor from inside the Hillcrest State is outside of the several thousand dollars, but in the newest many.

Even if you you will pay all cash, it’s probably maybe not an informed use of the offers if you don’t are trying to do a very brief revision or improve. To own larger house renovations plans, i encourage playing with cash in order to counterbalance exactly how much you’ll want to obtain. This is actually the safest choice, however, there are so many so much more.

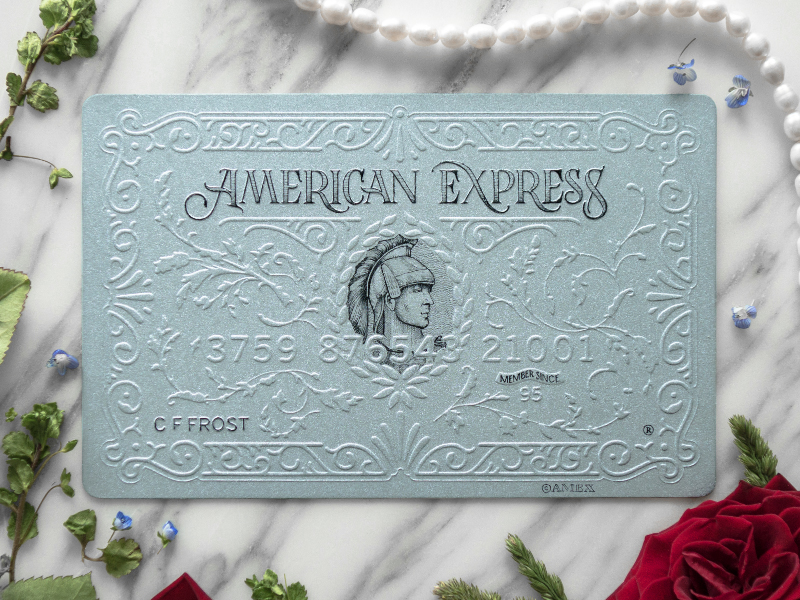

Alternative 2: Low-Appeal Playing cards

When you’re a homeowner, you most likely become mocked with plenty of charge card offerings more than their mature existence. When you find yourself borrowing is fit, there is nothing incorrect that have placing brief so you’re able to medium-sized domestic repair projects to your a zero best attract otherwise low interest credit card.

It trick we have found to naturally spend it regarding quickly, so we try not to highly recommend placing an effective $20,000 opportunity towards a charge. Really ponder, am i going to have the ability to shell out which regarding through to the borrowing credit bring expires and i also beginning to accrue appeal? When you are unsure by any means, usually do not take action.

But if you know you have got high borrowing from the bank, and certainly will pay-off the balance from the proper amount of big date, this is a viable selection for your.

Choice 3: Cash-Out Refinance

Depending on how a lot of time you have been of your house, a good alternative was dollars-away refinancing. An earnings-away re-finance is a great fit for biggest domestic fixes, ree you can combine high-attract loans. This program concerns refinancing your house and taking out guarantee and you can including considering future well worth after advancements.

There are many different bank options for cash-away refinancing. Start by your mortgage-holder, individual lender relationships or borrowing unionpare those for other loan providers or manage a pattern-make corporation who has a love having a location bank.

Something you should keep in mind in relation to this is the prices recover of one’s type of renovation venture. As you will end up with your family as the guarantee against a much bigger mortgage, you need to make advancements that can improve your residence’s really worth. Perform a little research and have their building work builder concerning the expected rates recoup of numerous domestic renovations strategies prior to getting come.