quickest cash advance

Knowing as to why, you might find out the way to method the trouble

Over the past long-time, property owners have observed a wave of brand new technology built to create our belongings wiser, better and easier to steadfastly keep up. Now this is simply not at all uncommon to have a robot machine, videos doorbells otherwise a keen Alexa in order to power on the lights, gamble tunes or give you reminders to get whole milk from this new supermarket.

Exactly what Communications you may anticipate Into the Mortgage Techniques

To get a house is most likely the biggest financial exchange you could make during the a life and you can interaction is paramount to restricting fret inside financial procedure. When you find yourself hiccups can take place home to order process, it is critical to have obvious, discover interaction along with your mortgage pro to attenuate the potential for interruptions also to make sure that your requirement was found. Becoming available to prospective products that may come up makes them better to deal with and you may our better-instructed group is here now so you’re able to throughout the procedure.

What does Servicing My personal Loan Imply?

Once you begin fucking on to the field of a residential property mortgages, while the you undoubtedly currently seen, there are a new arena of terminology and you will https://paydayloancolorado.net/mount-crested-butte/ acronyms that appear designed to confuse your! We shall falter the distinctions and you can parallels anywhere between loan providers and you may mortgage financing servicers, and offer ideas away from educated consumers so you’re able to browse the mortgage landscaping.

How to proceed otherwise be eligible for the borrowed funds amount you desired?

You have made the big decision to purchase property and you will moved from the app processes simply to learn that you do not be eligible for the total amount you wanted. So what now? You may have some choices to think, you should always speak to your financing expert locate aside why you didn’t qualify for the amount you wanted.

What kinds of Money Are there?

When you find yourself selecting to get a house, among the first things have to do are examine more kind of a home funds. Within United Society Borrowing from the bank Relationship, you’ll have several options offered all of our mortgage experts try reputation of the so you can purchase the best loan to you.

What You will have to Get home financing

No matter where you apply for home financing, the method constantly means many similar documents and you can types of advice away from you, the fresh borrower. Loan providers have their own unique versions and needs as well on are not questioned-getting advice, definitely. You’ll find four specific products which are expected nearly everywhere, and having this type of data files and you can recommendations built prior to starting financing software could make the procedure far much easier. Collect this article to your a packet ahead, and you will certainly be prior to the games! Below are a few tips about things to ready yourself:

Why you ought to Domestic Look regarding Winter months

When we think of supposed house bing search, i tend to image bright skies and spring season big date, perhaps not cooler and dreary months. Don’t let one frighten your, and there’s in fact several advantages to house bing search throughout the wintertime. In addition household search 12 months is beginning very early that it year!

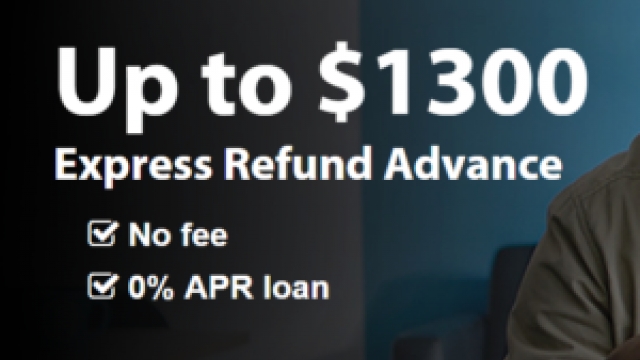

Annual percentage rate = Apr. Membership/Typical Family savings needed. Short-time bring. Joined Community rules, terminology, requirements and you may limits use. Established United Heritage funds perhaps not eligible. Prices and you will fees susceptible to transform without notice. Apr is susceptible to underwriting recognition that will improve dependent on debtor certification, applicable loans costs otherwise repayment term. Cash-out is actually a great fifty(a)(6) earliest lien merely. Settlement costs use. step 1 Request an income tax mentor off deductibility of interest. 2 Colorado Cash out mortgage records is Part fifty(a)(6). Applicable Tx Domestic Lending Legislation implement. Equivalent Homes Possibility. NMLS #630601