where can i get a payday loan near me?

A close look from the USDA Rural Invention Mortgage

Really does the notion of surviving in the world otherwise suburbs desire to you personally? Think about to invest in a home no currency down? With good USDA Outlying Development mortgage, can be done each other!

USDA (RD) mortgages are bodies recognized financing. The mortgage try financed otherwise got its start because of the a loan provider (such MiMutual Financial) however, has actually a guarantee regarding United states Department of Farming Rural Creativity (USDA RD). Due to this verify, there’s smaller chance into lender, ergo enabling far more favorable financing terms towards borrower.

Zero Down-payment:

Even the better advantageous asset of an effective USDA RD financing ‘s the downpayment criteria. At this time, many individuals find it hard to put away a tremendous amount off savings. Usually, rescuing right up to possess a downpayment is actually cited as one of the largest traps so you’re able to homeownership.

Versatile Borrowing from the bank Criteria:

USDA RD loans do have more lenient credit standards and you can bankruptcy assistance in comparison loans Morris with antique funds. Since USDA alone will not lay the absolute minimum credit score, loan providers put their own minimums. Of several lenders wanted a get of at least 640. MiMutual Financial, however, lets credit ratings as little as 580, making this loan program an excellent selection for consumers with less-than-finest credit records. This autonomy opens up ventures for those who have came across monetary pressures in past times.

Keep costs down

USDA RD financing supply the least expensive financial insurance premiums when than the almost every other mortgage apps. The initial home loan top (MIP) while the annual financial insurance policy is less costly than are you’ll need for FHA loans. The latest RD MIP and usually cost less than just old-fashioned Individual Mortgage Insurance policies (PMI).

Likewise, not every one of their settlement costs need leave pouch. Your own settlement costs should be secure as a consequence of vendor concessions (as much as six% of one’s price) or thanks to gives, gift funds, otherwise condition Advance payment Guidance (DPA) programs.

Not simply for purchase:

MiMutual Financial has the benefit of USDA RD funds for both to shop for otherwise refinancing property. If you order or refi, accredited borrowers qualify to have 100% capital. This new RD Streamline system allows you to re-finance your current RD mortgage easily! Since title indicates, the process is a more quickly, sleek process that waives new termite, really, and you can septic monitors. And no the fresh new appraisal will become necessary!

Help having Outlying and you may Residential district Parts:

USDA RD fund are specially made to support outlying and you can residential district teams. Which ensures that anyone residing in such portion gain access to affordable financial support possibilities when you find yourself generating economic invention and you can stability.

Very, now that we have discussed the key benefits of the new RD loan, allows look closer from the some of the eligibility standards:

Discover income direction

You don’t have to feel a first-big date home visitors, however you do need to see certain money direction. RD finance specify one to a debtor try not to exceed 115% of their local average household income. Observe the modern earnings qualification limits, look at the USDA RD website in the:

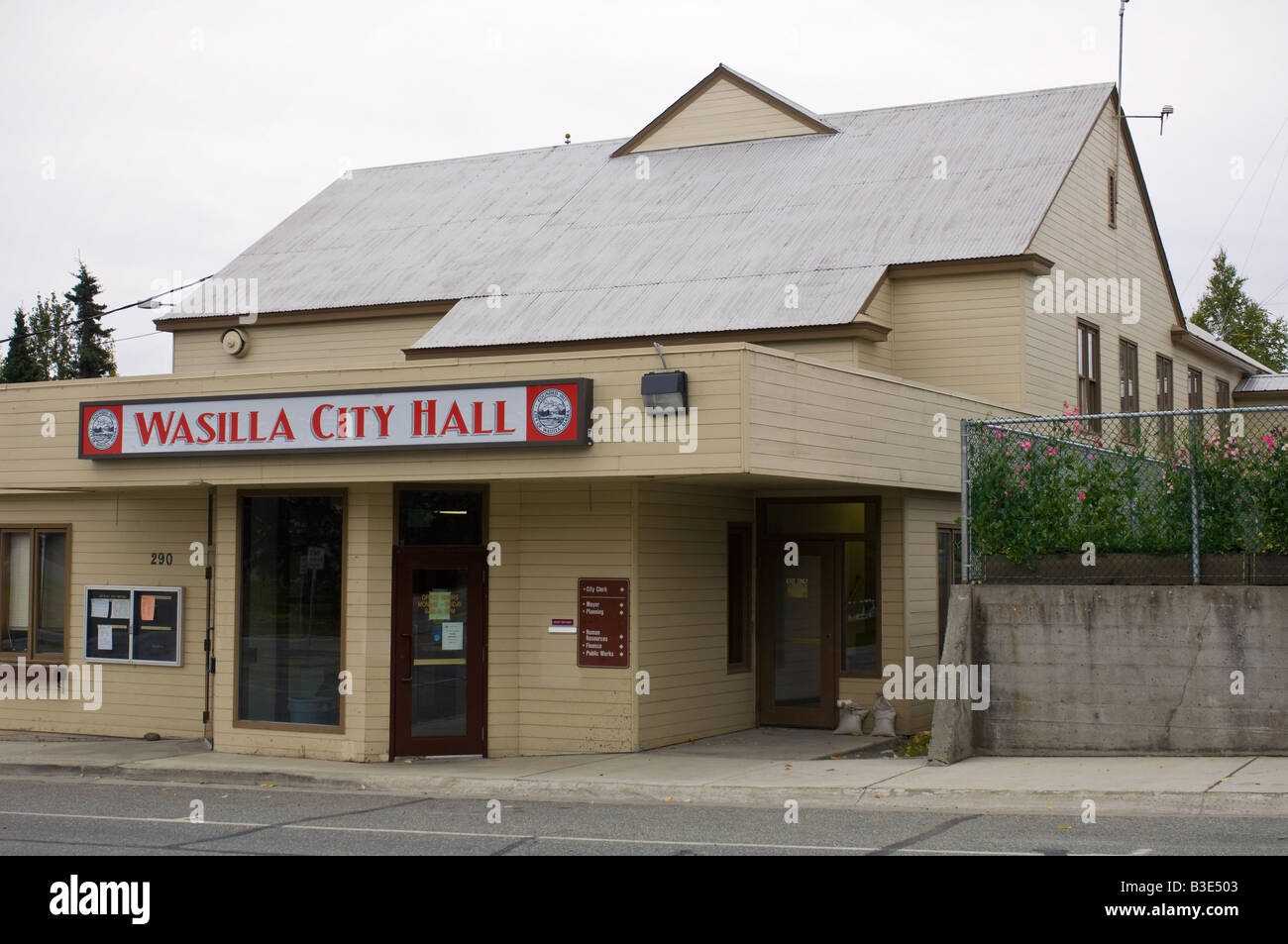

The property need to be located in an outlying area

You are questioning, what is actually believed outlying? There are various of definitions in what comprises an effective rural urban area vs a metropolitan or location town which normally produce distress regarding a beneficial property’s system qualification. Many anyone think of remote, dusty condition ways when they thought outlying, you might be astonished at just how many features can be found in a good USDA defined rural’ area. Inhabitants, geographical separation, and the regional work field all are items noticed.

The best way to determine if your house is when you look at the a great USDA appointed rural city is always to investigate program’s qualification map on: Click!

Mortgage terms and conditions, limits, and you may eligible assets types

In lieu of a traditional or FHA loan, USDA doesn’t place a max mortgage matter for RD fund. With no maximum sales rates, this may opened the choices. Yet not, RD money are just readily available as the a 30-season repaired financial, and you will again, need to be situated in a place identified as rural.

Eligible property designs become solitary nearest and dearest residential property, PUDs, brand new build (identified as less than one year old that have Certificate out of Occupancy),quick conversion and foreclosed house, webpages condos and you can existing were created home entitled to the new Are made Home Pilot Program (particular condition qualifications restrictions use).

Attributes maybe not qualified to receive RD resource is individuals who are earnings-promoting, lower than build, based in a city and you will/or perhaps not considered since decent, safe and sanitary (DSS) because of the USDA criteria. DSS requirements in a nutshell, guarantee the residence is structurally safe and sound, and all things in an excellent operating purchase. If the a property is not meeting DSS criteria, it needs to be listed in a great fix ahead of resource or with the financing loans.

As you can see, USDA RD money are a good solution if you’re looking to call home off of the defeated street and want 100% investment having Zero off. Thus, if you’re Ready to go Outlying, our company is willing to assist allow you to get here!