payday loans cash advance america

First, check to see in the event the a home loan re-finance is right for you, or if you’ll find most useful possibilities offered

You can make use of so it currency to settle highest-interest loans, for example credit cards, otherwise make use of it to cover renovations or do-it-yourself methods.

When you have one or two mortgage loans, you can also use a home loan re-finance in order to combine your second financial along with your first-mortgage. Eg, maybe you took away the second home loan from a private mortgage financial who’s got a top financial interest. The majority of your mortgage are $300,100, your next mortgage are $two hundred,one hundred thousand, along with your house’s really worth are $800,one hundred thousand. You could re-finance so you can combine very first and next mortgage loans for the you to definitely $500,000 financial. This can help express their mortgage repayments and relieve the cost of one’s mortgage loans if your 2nd home loan had a higher rate.

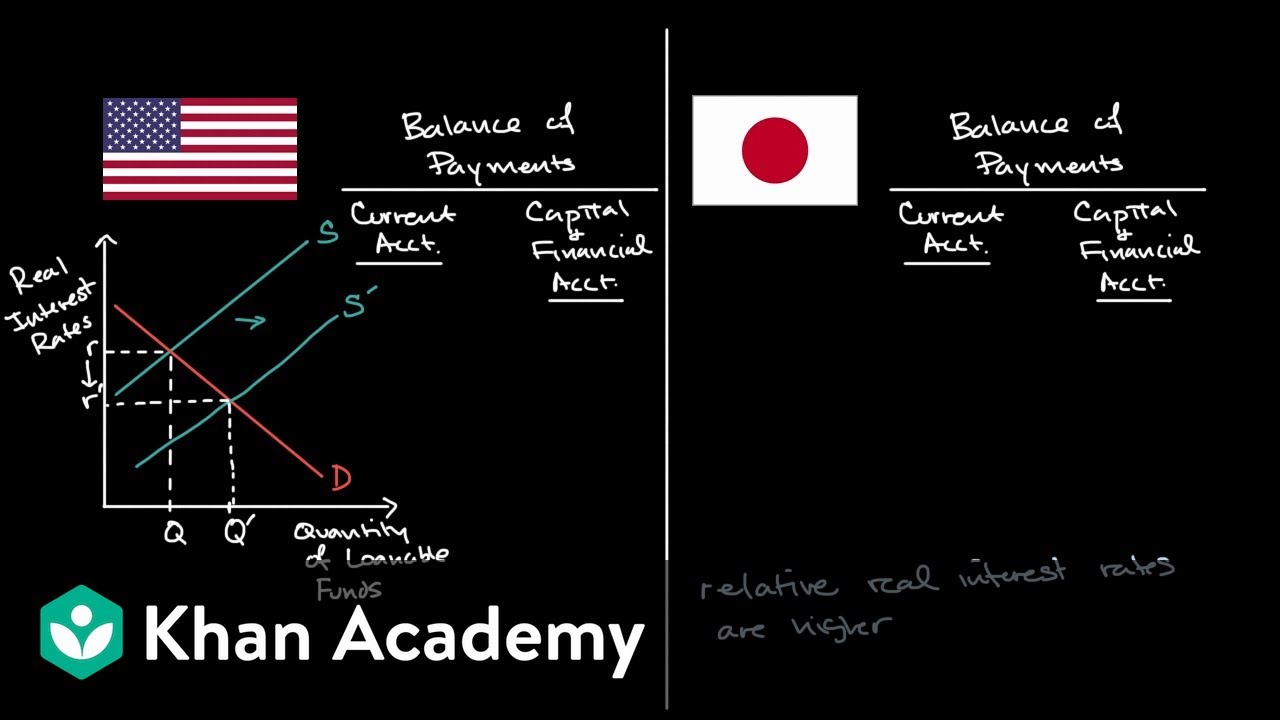

To locate a lower interest

Fixed-speed mortgages lock your on a flat rate of interest into the period of your financial title. If interest http://www.paydayloansconnecticut.com/east-brooklyn/ levels slide during your title, you simply will not be able to take advantage of a predetermined financial rates if you do not possibly replace your mortgage after your own name otherwise re-finance via your term.

If you refinance prior to their mortgage are upwards for renewal, their home loan company may charge significant home loan charges as you will feel cracking their financial. Observe if you’ll be able to save money due to a lower rate of interest immediately following financial prepayment penalties is recharged, play with our mortgage refinance calculator.

To modify your home loan method of

Refinancing your own home loan enables you to alter all aspects of financial. Instance, you might want to expand your mortgage amortization to help you enjoys all the way down month-to-month mortgage repayments, or you could must change to another financial product which have has actually which you such require, for example prepayment rights. For people who actually have a changeable-rate home loan and you believe that rates of interest will increase rather in the near future, you might want to switch to a predetermined-speed financial to help you protect less price now. You might move from a varying financial price so you’re able to a predetermined home loan rates once you refinance your own mortgage.

Some mortgage brokers provide mortgages that allow you to option home loan rate models the versus refinancing otherwise one punishment that include refinancing. Such as, CIBC’s Variable Fold Home loan try an adjustable-speed home loan that can easily be translated any moment to a beneficial fixed-speed financial with a term of at least three years.

How do i Refinance My Mortgage?

When you find yourself refinancing discover less rate of interest, find out in the event your interest coupons is over any mortgage penalties that you’d need to pay. If you’re looking to obtain extra money, their refinanced mortgage can’t be more than 80% of your house value.

After you have computed exactly why you must refinance and you can what we need to change, comparison shop with various mortgage lenders and you may home loans. You do not have in order to refinance and become along with your most recent home loan company. Other lenders may offer down financial re-finance rates than simply your current lender. But not, modifying lenders come with charges, like release costs.

Refinancing your own home loan is like applying for a unique home loan. You will need to get shell out stubs, taxation statements, and you can comments to add towards bank. You will have to citation the mortgage fret sample at your the fresh new refinanced home loan harmony, and you can should also has actually a property assessment used.

Home loan Refinance Costs

Financial re-finance pricing are generally more than cost offered for brand new household requests as well as for home loan renewals or transmits. That is because financial refinances try a bit riskier having mortgage lenders, due to the fact you are able to obtain more money when refinancing. Regardless of if you’re not credit more funds, you are refinancing when planning on taking advantageous asset of a lowered mortgage rate, and therefore lenders may prefer to prevent. The Canada home loan rates page allows you to compare financial re-finance prices of refinancing loan providers around the Canada.