what do i need to get a cash advance

Must i get a fixed speed home loan?

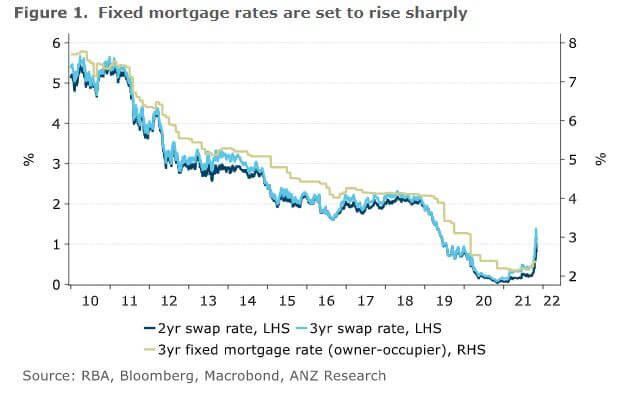

not, with financial prices increasing over the last year, it may not be the ideal time to agree to such as a long-identity bargain.

Selecting the most appropriate home loan can save you several if not many off weight, whether you’re to invest in a house otherwise remortgaging. Interested in a lender? Take a look at the most readily useful mortgage brokers.

If you would like their month-to-month payments is predictable having good lay very long time, a fixed price home loan is usually wise.

It provides the latest certainty regarding being aware what your instalments will be provided the deal persists. Therefore helps it be more straightforward to funds and form you won’t rating an urgent expenses in the event that interest rates raise.

Mortgage prices have raised substantially because the . See how financial costs enjoys changed. Nevertheless would be a smart idea to secure a beneficial speed now as it’s it is possible to might consistently wade up.

- Simply pick a fixed contract if you plan to store your house regarding period of time, which will usually getting several so you’re able to 5 years. If you exit before the price finishes, you are stung which have an early on-installment costs.

- If you believe you can promote your house before bargain ends, it should be not a good tip in order to go for an extended-term you to definitely.

Try a basic adjustable price home loan a good idea?

New SVR is the lender’s standard rate. It is usually much more expensive than going for a predetermined price or tracker deal, so it’s unlikely becoming the most suitable choice.

People don’t always join a basic adjustable price home loan. Most of the time you are going to roll onto the SVR immediately in the event the the repaired contract features ended. Which is, if you don’t plan a special deal ahead of your old that elapses.

When you are nearby the avoid out of a deal, you could avoid the SVR of the remortgaging alternatively, otherwise by the using a special home loan with the same financial, entitled a product or service transfer. Learn more about if or not now Read Full Article is an enjoyable experience in order to remortgage.

Is actually guarantor mortgage loans smart?

An effective guarantor mortgage works by providing a grandfather or another friend to agree to pay for your own mortgage payments if you refuse to be able to cause them to.

With this verify in place, you are able to use more and when planning on taking the fresh new first faltering step onto the possessions ladder with a tiny put.

This is exactly a choice to envision in the event the, state, you simply has a tiny from inside the deals, or if you has actually a low income, or otherwise not much credit history.

you need to go into the particularly a plan which have alerting; for folks who get behind towards repayments, your loved ones will be required to pay for all of them. This is certainly a huge commitment to generate.

Before signing right up, think about if a beneficial guarantor mortgage is right for you. Read more regarding the buying your basic domestic or other let that would be available.

Should you decide remove an extended-label financial?

This new prolonged the borrowed funds title, the lower the monthly money. This may allow you to be much warmer economically monthly as you pay it off.

However, you’ll find downsides so you can taking right out a super-long home loan because takes you many years to pay it of and it will charge you a lot more about a lot of time run. This is because you are repaying interest for extended.

In contrast, the new reduced the borrowed funds name the brand new reduced you have to pay off of the home loan and totally very own your house. But of course your month-to-month costs could be big, so it’s crucial that you be sure to don’t over-increase oneself.