paydayloanalabama.com+prattville payday loan instant funding no credit check

You will find another risk with HELOCs: Their financial may have the capability to get rid of otherwise freeze your own personal line of credit

In such a case, the most you’ll be able to use are $forty,000. This is how which is determined, of course, if there are not any almost every other liens on the house.

Are there extra charges?

Setting-up your HELOC may cost hundreds of dollars into the charges. Listed below are some of your fees you could discover with a HELOC.

- Assessment costs

- App costs

- Initial costs, for example facts

- Attorney fees

- Name research charge

- Home loan thinking and filing

- Annual commission

- Exchange charge

Many of the terminology and fees to have HELOCs decided by the lending company, therefore it is smart to search such basic facts before you can enter into people agreement. Some conditions could even be available to discussion.

Bear in mind that additionally, you will spend notice. While most HELOCs bring variable rates, they might also come having basic costs, that’s lower than normal rates but are short term. Definitely comparison shop and examine.

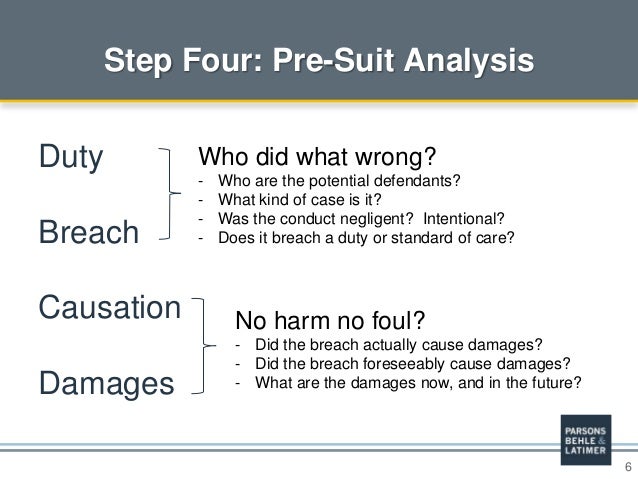

The risks out of a HELOC

There are a number of threats having HELOCs, however, one huge exposure is obvious. Since you use your home because the security, incapacity and then make money could cause the loss of your household.

Financial institutions has attempted to limit how much you can acquire to help protect up against such as for example loss, although chance however is present for folks who instantly end up being not able to improve necessary repayments.

Loan providers normally simply get this to disperse due to missed money, alterations in your own residence’s guarantee or in the midst of monetary trauma, but it’s nevertheless a chance worth taking into consideration.

An effective HELOC’s interest rate is sometimes variable and certainly will alter. The pace is normally associated with the top speed and you will will likely be influenced by alterations in the marketplace over the lifestyle of HELOC.

There could be limits compared to that suspicion, even in the event, such as a periodic cap (a threshold to the price changes at any given time) or a lives cover (a limit for the rates changes inside loan identity).

Some options to help you a HELOC

If you’re https://paydayloanalabama.com/prattville/ considering a beneficial HELOC although not sure simple fact is that proper solution for your requirements, listed below are some options to consider.

Household collateral funds

Household security financing and HELOCs keeps similarities. But if you understand the words put interchangeably, be aware that these two items are indeed different. And several of those differences you’ll decide which alternative might possibly be most readily useful to your requirements.

HELOCs and you can family guarantee money is actually equivalent: They both encompass credit up against your home guarantee and ultizing the new family itself as guarantee. The difference anywhere between a HELOC and you will house collateral loan may appear minor by comparison, nonetheless can be matter dramatically when it comes time so you’re able to acquire and you will shell out.

Such as, property guarantee financing does not support an effective revolving line of borrowing from the bank such as for instance an effective HELOC. Instead, you get the mortgage matter as a lump sum initial and you may spend lifetime of the mortgage using it straight back (and additionally focus) to your a flat cost schedule. This structure can be useful for many who know exactly just how far money they want if in case they will be in a position to spend it back.

A property equity loan including constantly offers a fixed rate of interest, that render significantly more safeguards along side longevity of the loan. This might allows you to bundle more readily whenever putting together a resources on the loan’s fees agenda. With the downside, the soundness of these repaired rate usually means it is more than the rate you could get to have a HELOC.

Cash-out re-finance

A cash-aside refinance in addition to comes to borrowing from the bank money resistant to the property value your own family, but it requires the full refinancing of your own mortgage in place of establishing a unique agreement.